Measuring Significance For Correlations Using Excel 2011 Mac

XLSTAT is the leading data analysis and statistical solution for Microsoft Excel®. The XLSTAT statistical analysis add-in offers a wide variety of functions to enhance the analytical capabilities of Excel, making it the ideal tool for your everyday data analysis and statistics requirements. The XLSTAT statistical analysis software is compatible with all Excel versions from version 2003 to version 2016 (2011 and 2016 for Mac), and is compatible with Windows Vista to Windows 10 systems, as well as with PowerPC and Intel based Mac systems. Because it is powerful, reliable, affordable, easy to install and to use, XLSTAT has grown to be one of the most commonly used statistical software packages on the market. Today, the XLSTAT community includes more than 100,000 users, businesses and universities, large and small, in over 200 countries across the world.

Annual licenses start as low as $50 for students, $165 for academics and $275 USD for other users, making XLSTAT eminently affordable. In addition, XLSTAT offers top level support services that free statistical software solutions do not provide. XLSTAT can be purchased online through a highly secured site, anytime, anywhere.

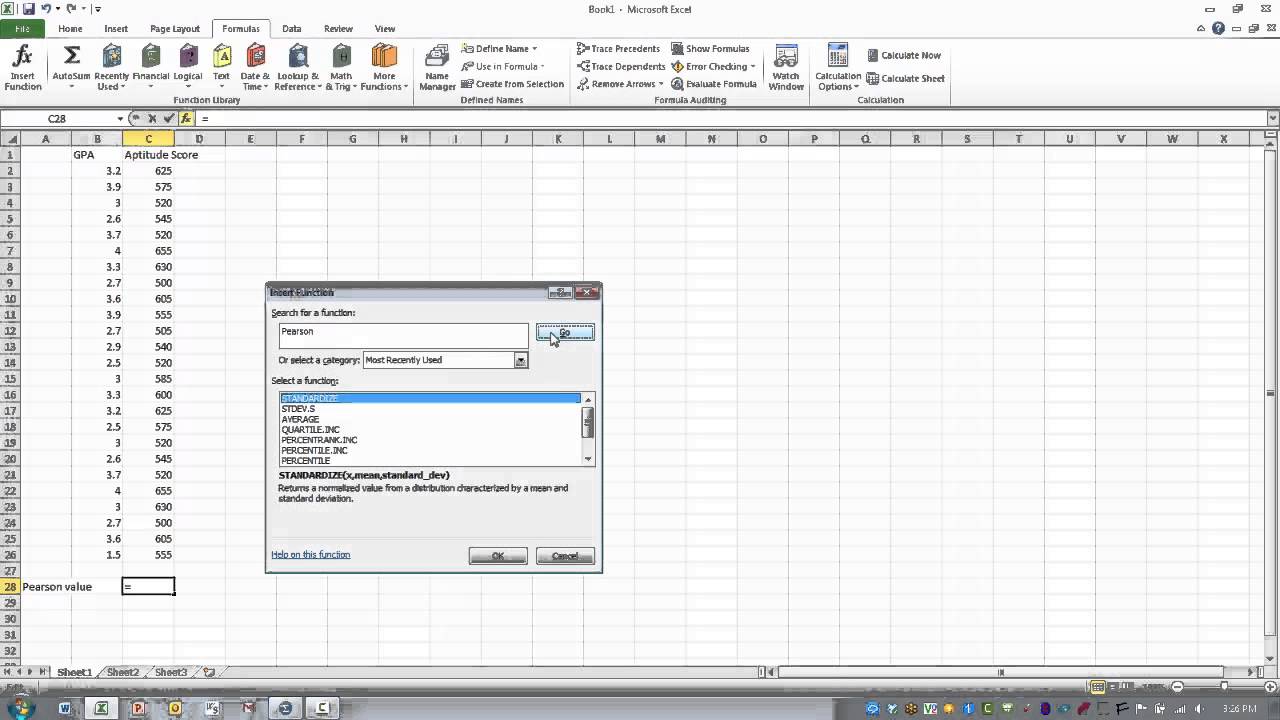

Correlation Coefficient in Excel Makes the Calculation of Correlation Simple February 7, 2014 by Brigitta Schwulst Microsoft Excel is the most popular spreadsheet available today and part of the reason for its popularity is the fact that Excel comes standard with hundreds of functions and formulas. Feb 18, 2012 Re: How to run a correlation on excel 2011 (mac) By r do you mean Pearson's correlation coefficient that represents the 'goodness of fit' of a correlation? If you just need r but not the actual correlation, I'm amost certain there is a built in function for that (search Excel help for.

Correlations Using Excel

Both electronic and CD-Rom versions are available.

Pearson’s correlation coefficient, normally denoted as r, is a statistical value that measures the linear relationship between two variables. It ranges in value from +1 to -1, indicating a perfect positive and negative linear relationship respectively between two variables.

Measuring Significance For Correlations Using Excel 2011 Mac

The calculation of the correlation coefficient is normally performed by statistical programs, such SPSS and SAS, to provide the most accurate possible values for reporting in scientific studies. The interpretation and use of Pearson’s correlation coefficient varies based on the context and purpose of the respective study in which it is calculated. Interpret the correlation coefficient based on the context of the particular data set. The correlation value is essentially an arbitrary value that must be applied based on the variables being compared. For example, a resulting r value of 0.912 indicates a very strong and positive linear relationship between two variables.  In a study comparing two variables that are not normally identified as related, these results provide evidence that one variable may positively affect the other variable, resulting in cause for further research between the two. However, the exact same r value in a study comparing two variables that are proven to have a perfectly positive linear relationship may identify an error in the data or other potential problems in the experimental design.

In a study comparing two variables that are not normally identified as related, these results provide evidence that one variable may positively affect the other variable, resulting in cause for further research between the two. However, the exact same r value in a study comparing two variables that are proven to have a perfectly positive linear relationship may identify an error in the data or other potential problems in the experimental design.

Thus, it is important to understand the context of the data when reporting and interpreting Pearson’s correlation coefficient. Determine the significance of the results. This is accomplished using the correlation coefficient, degrees of freedom and a Critical Values of the Correlation Coefficient table. The degrees of freedom is calculated as the number of paired observations minus 2. Using this value, identify the corresponding critical value in the correlation table for either a 0.05 and 0.01 test identifying 95 and 99 percent confidence level respectively.

Compare the critical value to the previously calculated correlation coefficient. If the correlation coefficient is greater, the results are said to be of significance.

Ken Fisher wrote the Forbes Portfolio Strategy column for 32 ½ years until Dec. 31, 2016, making him the longest running columnist in Forbes’ history. He is also the founder, executive chairman and co-chief investment officer of Fisher Investments, an independent, fee-only investment adviser serving a global client base of diverse investors. He is the author of 11 books, 6 of which are national best sellers. Ken Fisher started writing his monthly column in 1984, the same year he gained international attention for his book Super Stocks, which popularized the price-to-sales ratio. His writing for Forbes was commemorated in a book published by Wiley in 2010, The Making of a Market Guru: Forbes Presents 25 Years of Ken Fisher. He was honored by Investment Advisor magazine as one of the industry's 30 most influential individuals over the last 30 years (Thirty for Thirty, May 2010).